It’s called Fartcoin, yes. Indeed, it is completely pointless.

Indeed, it has increased in value over the last week to a market valuation of over $800 million, roughly matching the market capitalizations of Office Depot, Guess clothing, and Steak N Shake’s parent company.

The value of Fartcoin fluctuated the day after this article was published. About $620 million was its starting price at 7 a.m. ET on Sunday. It reached a height of $889 million before dropping back to $836 million at 9:35 p.m. ET on Monday.

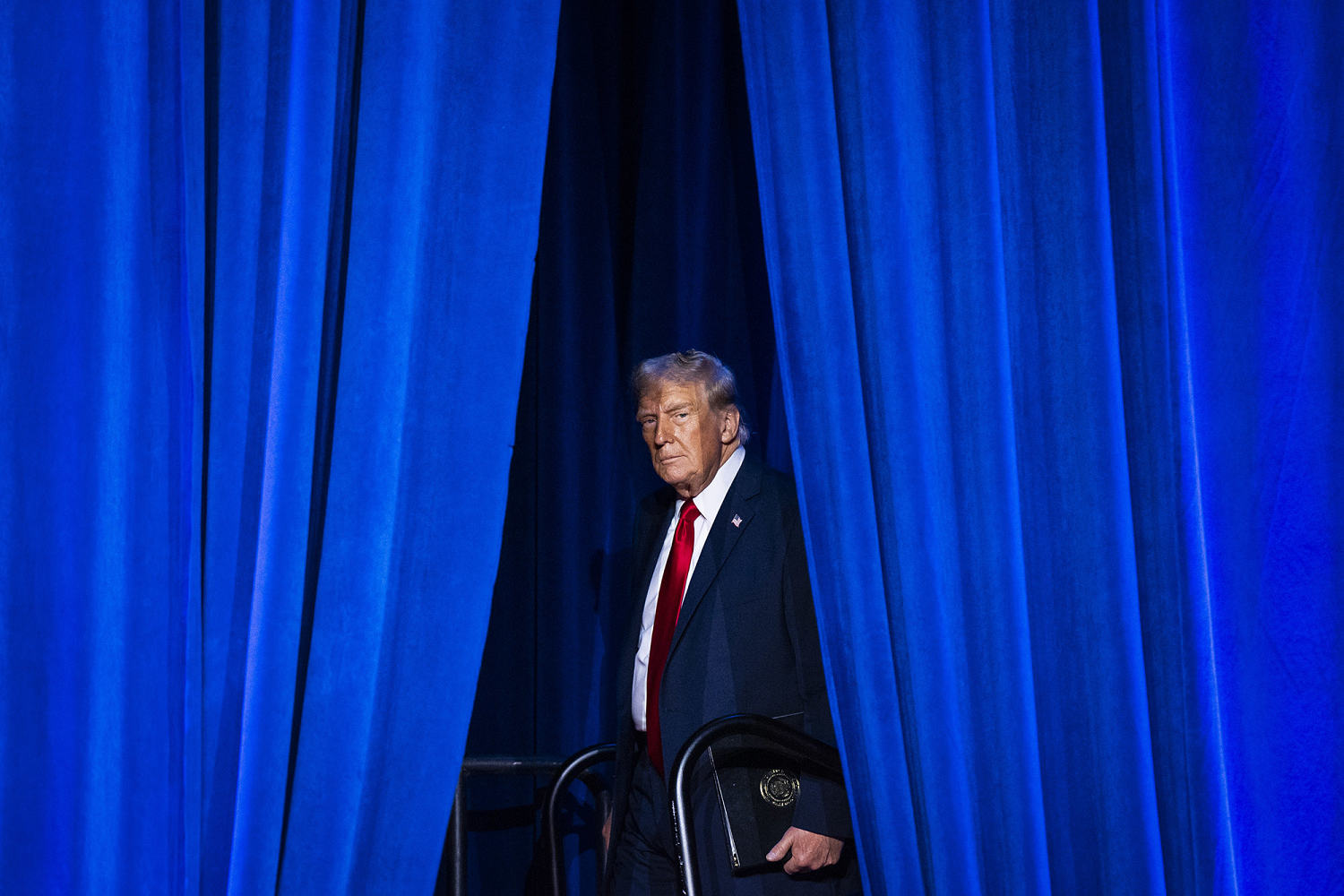

Riding a larger wave of bitcoin investment that was sparked by Donald Trump’s election, the carnival-casino age of cryptocurrency has returned with a fury. Even the losers seem to be in on the joke, even though it’s making millionaires while maybe hurting others.

According to Toe Bautista, research analyst for GSR, a decentralized finance firm, the flood of memecoiners consists of both lifelong bitcoin holders and those who are just frantic to turn their fortunes in an era of sky-priced homes and stocks. According to Bautista, many memecoin traders who have benefited from bitcoin’s 130% surge this year—50% of which has occurred since Trump’s win last month—are merely shifting down the risk curve into regions of pure speculation. Others see the possibility of earning ten times their money in a single day.

“A lot of people think that by having a better chance at winning a lottery ticket, I can get some sort of edge,” Bautista remarked.

According to Bautista, the majority of memecoin buyers and sellers are aware that their trading activity equates to the riskiest kind of gambling. To avoid being left holding the bag and failing to trade up and strike when the price is high, it all comes down to getting out of one’s position.

He referred to the notion that someone else will pay more for a certain memecoin, saying, “Because they’re worthless, you’re betting on the greater fool.” You’re assuming that since I’m early, the bags will be purchased by someone. But its value isn’t driven by anything fundamental.

The biggest risk associated with trading memecoins, which are typically predicated on how long online memes last, is that the meme itself will eventually fade from the cultural zeitgeist. Indeed, a very small number of people can benefit greatly from a particular news cycle. Blockchain data shows at least one holder of a coin created in the wake of the Peanut the Squirrel incident last month, which involved the death of a rodent possibly being kept without permission by a New York man, is sitting on nearly half a billion dollars.

Today, that coin, PNUT, is down about half from its peak value of $2.47 as that news story has faded from view.

Yet there are also operational risks to memecoins, as illustrated by therise and rapid fall of Hawk coin, released earlier this month by Haliey Welch, a Tennessee woman who has parlayed a viral lewd street interview into a successful podcast.

Over the course of 24 hours, Hawk s market cap peaked at $500 million before collapsing to $28 million, prompting complaints about dramatic losses in funds. NBC News has not independently confirmed the concerns.

Facing accusations of insider trading, Welch released a statement saying neither she nor anyone on her team had sold the coins, blaming instead sniper algorithmic bots designed to sell as prices begin to surge.

Bautista said that indeed, algorithmic trading, which has long been part of mainstream trading on Wall Street, is now routinely deployed in the memecoin space. He estimates that of the top-20 traded coins in crypto, half are memecoins whose trades are almost entirely driven by bots designed to spot and respond to price movements.

Is it legal? Some believe memecoins are permitted because the Securities and Exchange Commission has never formally categorized bitcoin as a security. Yet the agency has taken actions against exchanges that have permitted trading of other tokens. And, crucially, many memecoins, including Fartcoin, do not appear able to be legally purchased from U.S. soil on most of the crypto exchanges offering them.

Ground zero for launching memecoins is a website called Pump.fun, which allows users to launch a coin that is instantly tradeable in one click for free. Launched in January 2024, the site has generated over $288.4 million in revenue since its inception, according to analytics datacited by CoinTelegraph, a crypto industry publication.

Earlier this month, the United Kingdom s Financial Conduct Authority said the website was not authorized in the country and warned anyone who interacted with a product or service associated with the site had no investor protections.

Despite this, the site s terms and conditions state that its provisions are governed by the laws of England.

A spokesperson for the website was not immediately available for comment.

It may be the digital Wild West, but some tools have been developed to help nonsavvy memecoin participants avoid outright scams. A site called Rugcheck.xyz bills itself as capable of scanning memecoin ownership data to determine whether an actor or small group of actors are capable of putting their thumb on the scale of the market. Pump.fun itself says it prevents rugs, or sudden price dumps, by making sure that any tokens it launches have no presales or small-batch allocations that would benefit insiders.

It is not clear how much longer the current crypto bull cycle will last, but at least one analyst believes it is still in relatively early innings given likely developments next year namely, potentially further reductions in interest rates by the Federal Reserve, and the implementation of more crypto-friendly policies by the Trump administration.

There are lots of events in 2025 that can help drive bitcoin and crypto prices up further, said Gracy Chen, CEO of crypto group Bitget, in an interview with NBC News.

In fact, Trump world has already shown signs of accelerating its embrace of cryptocurrencies.Bloomberg News reported on Fridaythat World Liberty Financial, a crypto project inspired by Trump, has been buying millions of dollars worth of tokens beyond bitcoin, a sign that the decentralized finance lending platform could launch soon. Trump has been named as an eventual financial beneficiary of World Liberty.

A spokesperson for World Liberty did not respond to a request for comment.

Yet there is clearly a dark side to the memecoin world. Omid Malekan, who teaches crypto at the Columbia Business School at Columbia University, said it is emblematic of the economic nihilism that has taken root among many young Americans who feel they have been priced out of the American Dream.

All these kids are like, All the good stocks are way too expensive. And houses? I can t afford them, Malekan said. So, I ll gamble on something that can 10x my money, and if I lose it all, Who cares, I was screwed anyway.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!