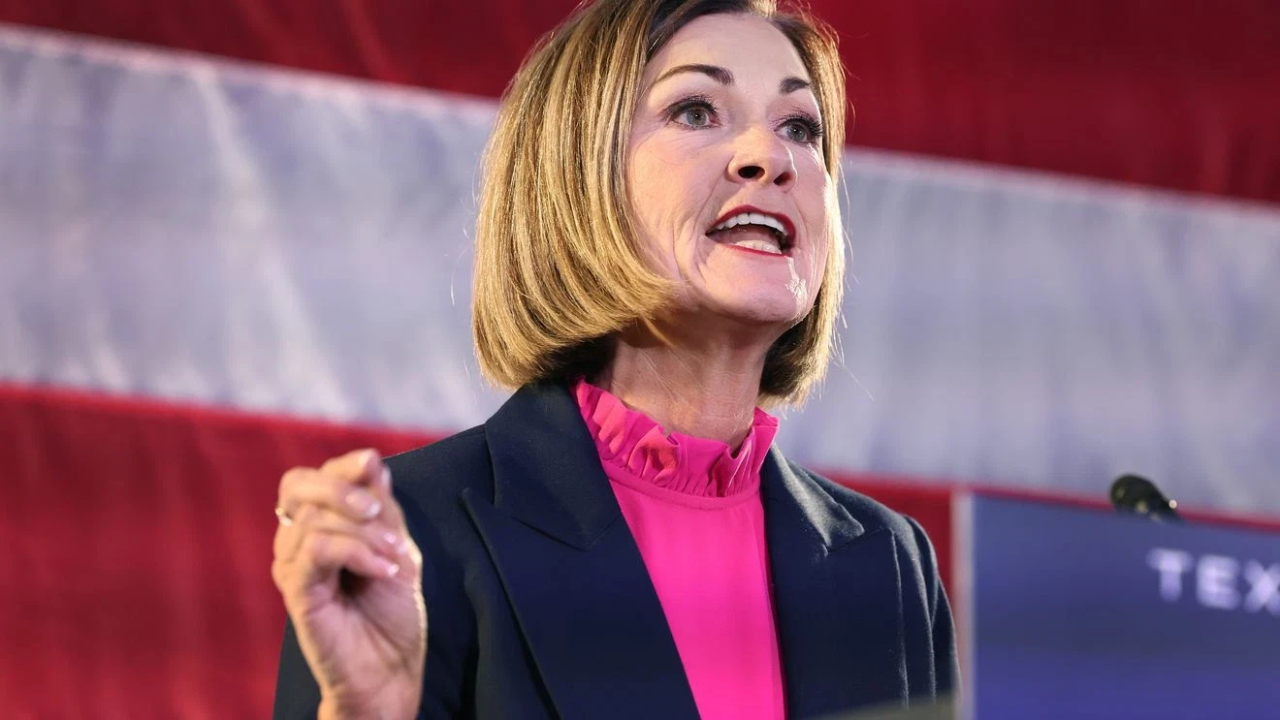

Iowa’s governor has announced plans to create a detailed plan aimed at reducing property taxes for residents across the state.

This move comes after growing concerns from homeowners and local communities about the rising cost of property taxes, which have become a significant financial burden for many families.

Property taxes in Iowa have been a hot topic recently, with many people feeling the pinch as their tax bills keep increasing.

These taxes help fund important services such as schools, roads, and public safety. However, many residents argue that the current rates are too high and make it harder for families to afford their homes.

The governor’s plan will focus on finding ways to lower the property tax rates without affecting the quality of essential services.

Officials are expected to work closely with lawmakers, local governments, and tax experts to build a balanced solution that benefits homeowners while keeping the state’s budget stable.

Iowa has seen property tax rates increase steadily in recent years, and this has sparked frustration among citizens and business owners alike. Many have voiced their concerns at town hall meetings and through public comments, urging the state government to take action.

The governor emphasized the importance of making property taxes fairer and more manageable for everyone. She stated that the plan will include detailed research on current tax policies and will consider how other states have successfully handled similar challenges.

In addition to reducing taxes, the governor also wants to ensure transparency in how tax dollars are spent. This will help build trust between residents and the government by showing exactly where the money goes and how it benefits communities.

The plan is still in its early stages, and the governor has not provided a specific timeline for when it will be ready. However, officials expect to present recommendations to the state legislature in the coming months.

Lawmakers will then review the proposal and decide on any necessary changes before passing new laws. This process will require cooperation from both political parties to make sure the final plan meets the needs of all Iowans.

Experts say that cutting property taxes can help boost the economy by allowing people to have more money to spend and invest. It can also encourage homeownership and help keep people in their communities longer.

At the same time, it is important to maintain funding for public services that rely on property tax revenue. Finding this balance is a challenge that the governor and lawmakers will need to address carefully.

Residents are hopeful that the governor’s plan will bring relief from the high tax bills and create a fairer system for everyone. Many look forward to seeing the details and participating in discussions as the plan develops.

Overall, the move to reduce property taxes in Iowa reflects a growing trend across several states, where governments are trying to ease financial pressures on citizens while keeping public services strong.

With the governor’s leadership, Iowa aims to create a practical and balanced approach that supports both taxpayers and communities. The coming months will be important as the plan takes shape and moves through the legislative process.