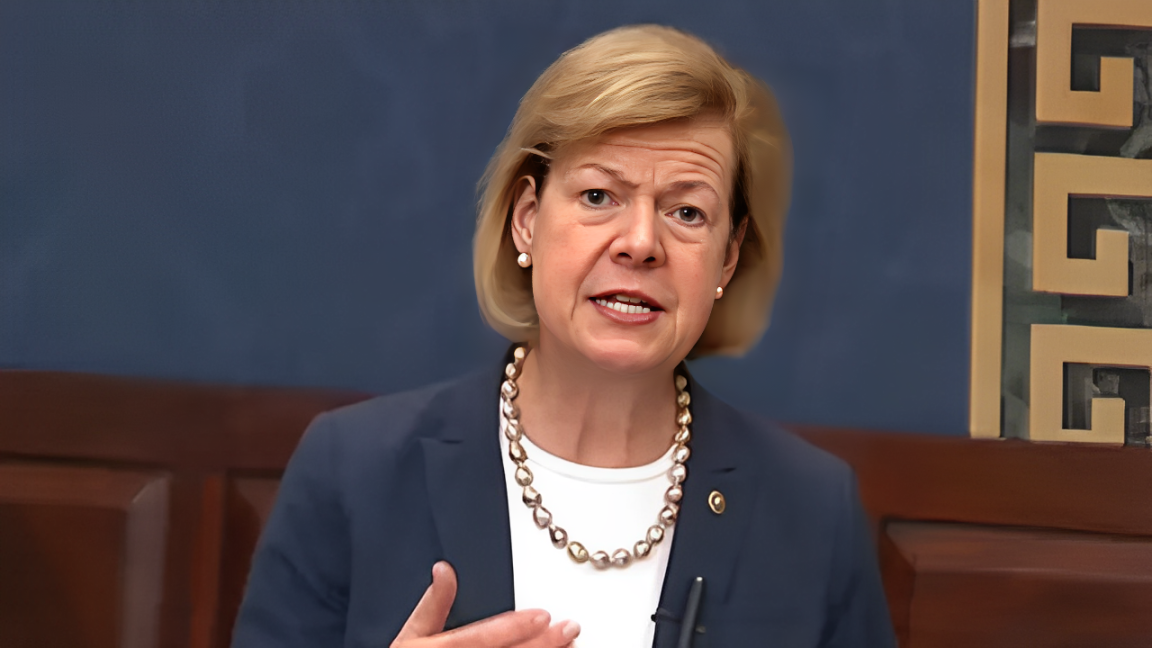

While Republicans advance legislation focused on tax breaks for corporations and Wall Street investors, U.S. Senator Tammy Baldwin (D-WI) has introduced two new bills aimed at delivering meaningful tax relief to hardworking Wisconsin families and individuals.

Senator Baldwin announced the American Family Act and the Tax Cuts for American Workers Act, both designed to ease financial pressure on middle- and low-income households across the state.

These proposals would expand access to the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC), offering significant tax cuts for working families and individuals without children.

“President Trump promised to lower costs for Wisconsin families, but instead, he sparked a trade war, raised prices, and created economic instability for local businesses and farmers,” said Senator Baldwin. “I’m proud to support tax cuts that give real breathing room to Wisconsin’s working families. While Republicans debate cutting programs like Medicaid to fund Wall Street giveaways, I’m focused on lowering costs for everyday Wisconsinites.”

The American Family Act

This legislation seeks to make permanent the enhanced Child Tax Credit originally expanded under the 2021 American Rescue Plan.

That expansion led to a historic drop in child poverty, which fell to just 5.2%—the lowest rate ever recorded. However, after Congress allowed the enhanced credit to expire, child poverty more than doubled to 12.4% in 2022.

Key Features of the American Family Act include:

- Expanded Credit Amounts: Increases the Child Tax Credit to $6,360 for newborns, $4,320 for children aged 1–6, and $3,600 for children aged 6–17.

- Equity for Low-Income Families: Ends a discriminatory policy that reduces the CTC for low-income families, helping approximately 17 million children—20.4% of all Wisconsin residents under 17—gain full access to the credit.

- Monthly Payments: Allows families to receive the credit in monthly installments to better manage household bills.

- Inflation Adjustment: Indexes the credit to inflation to preserve its real value over time.

The Tax Cuts for American Workers Act

Senator Baldwin’s second bill targets working Americans without children by expanding the Earned Income Tax Credit (EITC), a proven tool for lifting workers out of poverty.

According to 2023 data, over 305,000 Wisconsin workers claimed the EITC, with an average refund of $2,497. An estimated 236,000 workers without children in Wisconsin would benefit from the proposed expansions in 2024.

Highlights of the Tax Cuts for American Workers Act include:

- Increased Support: Triples the maximum EITC for childless workers from about $540 to $1,500.

- Wider Eligibility: Raises income eligibility limits from $16,000 to $21,000 for single filers and from $22,000 to $27,000 for married couples.

- Expanded Age Range: Makes the credit available to younger workers aged 19–24 and older workers 65 and above, who are currently excluded.

- Support for Foster Youth: Improves access to credit for adults transitioning out of the foster care system.

Senator Baldwin’s proposals underscore her commitment to making tax policy work for everyday Americans, not just corporations and the wealthy.

If passed, these bills would provide immediate and lasting relief to hundreds of thousands of Wisconsin families and individuals striving to make ends meet.

Disclaimer- Our team has thoroughly fact-checked this article to ensure its accuracy and maintain its credibility. We are committed to providing honest and reliable content for our readers.