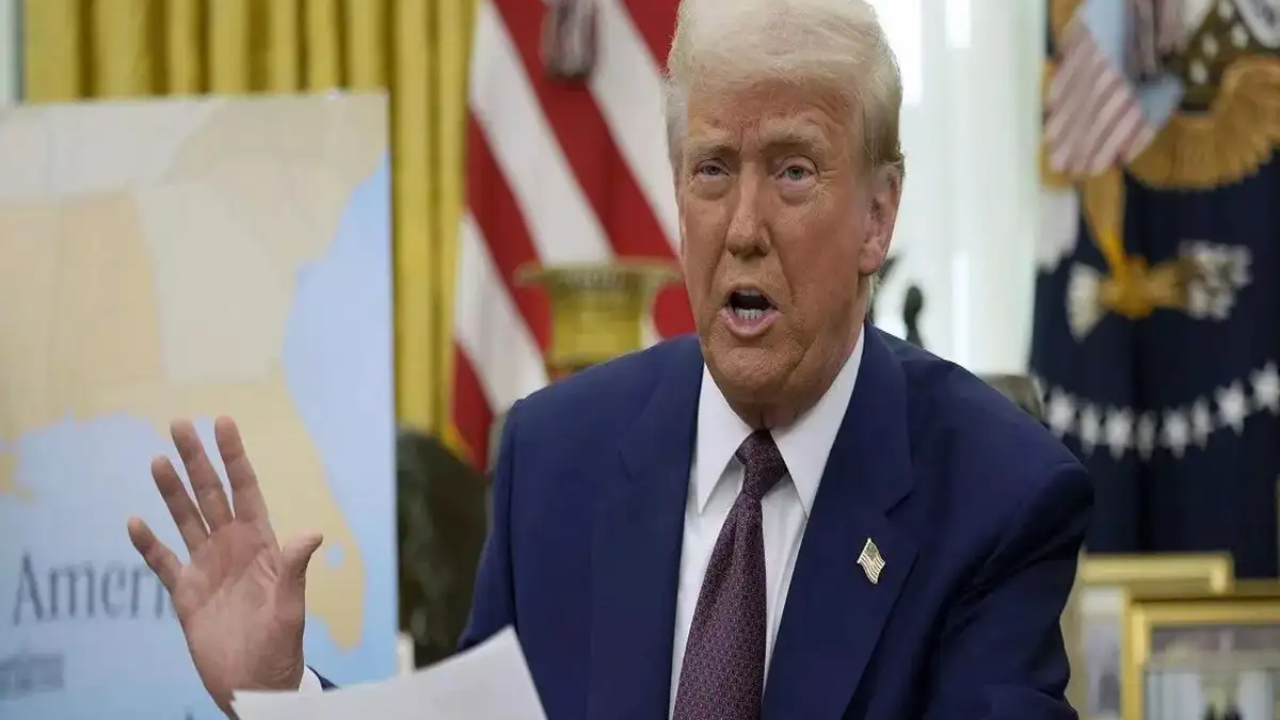

As the 2024 presidential election season heats up, one of the most talked-about issues is Social Security—specifically, whether former President Donald Trump is planning to give senior citizens a break on the taxes they pay on their Social Security benefits.

Many seniors across the country are hopeful. But is a real tax cut actually on the way? Or is this just campaign talk?

Here’s a simple explanation of what’s going on and what you should know.

What Did Trump Say?

In recent speeches and interviews, Donald Trump has hinted that if he returns to the White House in 2025, he will work to cut or eliminate taxes on Social Security benefits for seniors.

While he hasn’t released a detailed policy plan yet, this statement has gained a lot of attention, especially among older Americans who rely on monthly Social Security payments to cover living expenses.

Trump said he believes it’s unfair for seniors to be taxed twice: once when they earn the money during their working years, and again when they collect it during retirement.

But right now, that’s just a promise, not an official policy or signed law.

How Are Social Security Benefits Taxed Right Now?

Currently, the IRS taxes Social Security benefits based on your combined income, which includes your adjusted gross income, non-taxable interest, and half of your Social Security benefits.

Here’s how it breaks down:

- If you’re single and your combined income is between $25,000 and $34,000, you might pay tax on up to 50% of your Social Security benefits.

- If it’s more than $34,000, you might pay tax on up to 85% of your benefits.

- For couples filing jointly, the thresholds are $32,000 to $44,000 for 50% and above $44,000 for 85%.

This means many middle-class retirees still have to pay federal income tax on a large portion of their benefits.

Could Trump Make Social Security Benefits Tax-Free?

Technically, yes—but it would require congressional approval.

Social Security is governed by federal law, and any changes to how it’s taxed would have to pass through both the House of Representatives and the Senate.

Even if Trump wins the election, the makeup of Congress will matter a lot. If Republicans control both chambers, a Social Security tax cut for seniors has a higher chance of passing. If Democrats hold control or split power, the proposal could face heavy opposition.

In short, A tax cut is possible, but not guaranteed.

What Would Be the Impact of a Social Security Tax Cut?

If this tax cut becomes law, here’s what it might mean:

- More money in seniors’ pockets. Eliminating taxes on Social Security could save retirees hundreds or even thousands of dollars a year.

- A boost in support for Trump among older voters. Seniors are a powerful voting bloc, and this move could win favor.

- Possible long-term strain on the federal budget. Social Security taxes collected today help fund the program. Cutting this revenue could increase the program’s financial stress unless alternative funding is secured.

Experts warn that without careful planning, such a move could reduce funds available for future retirees unless offset by new revenue streams.

What Are Critics Saying?

Some critics argue that eliminating taxes on Social Security mostly benefits higher-income retirees—the ones whose income is high enough to be taxed on benefits in the first place.

Others raise concerns about the future of the Social Security Trust Fund. According to the Social Security Administration (SSA), the trust fund may run short of money by 2034 unless changes are made.

Critics worry that a tax cut now could speed up that shortfall if it’s not paired with other reforms or increased funding sources.

What Do Seniors Think?

Many seniors welcome the idea. For people on fixed incomes, even a few hundred dollars in tax savings per year can make a big difference, especially with rising costs of groceries, housing, and healthcare.

For example, a retiree receiving $24,000 per year in benefits could currently pay taxes on up to $20,400 of that amount if they have other income. A tax cut would provide real relief for such individuals.

However, seniors are also concerned about the long-term health of the Social Security program, especially younger retirees who may rely on benefits for the next two or three decades.

Is This Just a Campaign Promise?

At this stage, yes. Trump’s remarks are more of a campaign pitch than a formal policy plan. No official legislation has been introduced, and no detailed economic analysis has been shared by his campaign.

Still, the issue is gaining traction, and if Trump continues to push the idea and secures enough support in Congress, it could become a central part of his 2025 agenda.

What Should Seniors Do Now?

- Stay informed. Follow updates from the IRS, SSA, and trusted news outlets.

- Check current tax liabilities. Use the IRS Social Security Benefits Worksheet to see if your benefits are taxed.

- Watch the elections. The outcome in November 2024 will influence whether this idea turns into policy.

Final Thoughts

The idea of cutting or removing Social Security taxes for seniors is popular, but it’s still uncertain whether it will happen. President Trump has raised hopes, but making it real will depend on Congress, budget negotiations, and whether voters back the plan at the ballot box.

If you’re a senior, the best thing you can do is stay informed, understand how Social Security works for you, and keep a close eye on how this proposal evolves in the coming months.

Disclaimer- Our team has thoroughly fact-checked this article to ensure its accuracy and maintain its credibility. We are committed to providing honest and reliable content for our readers.